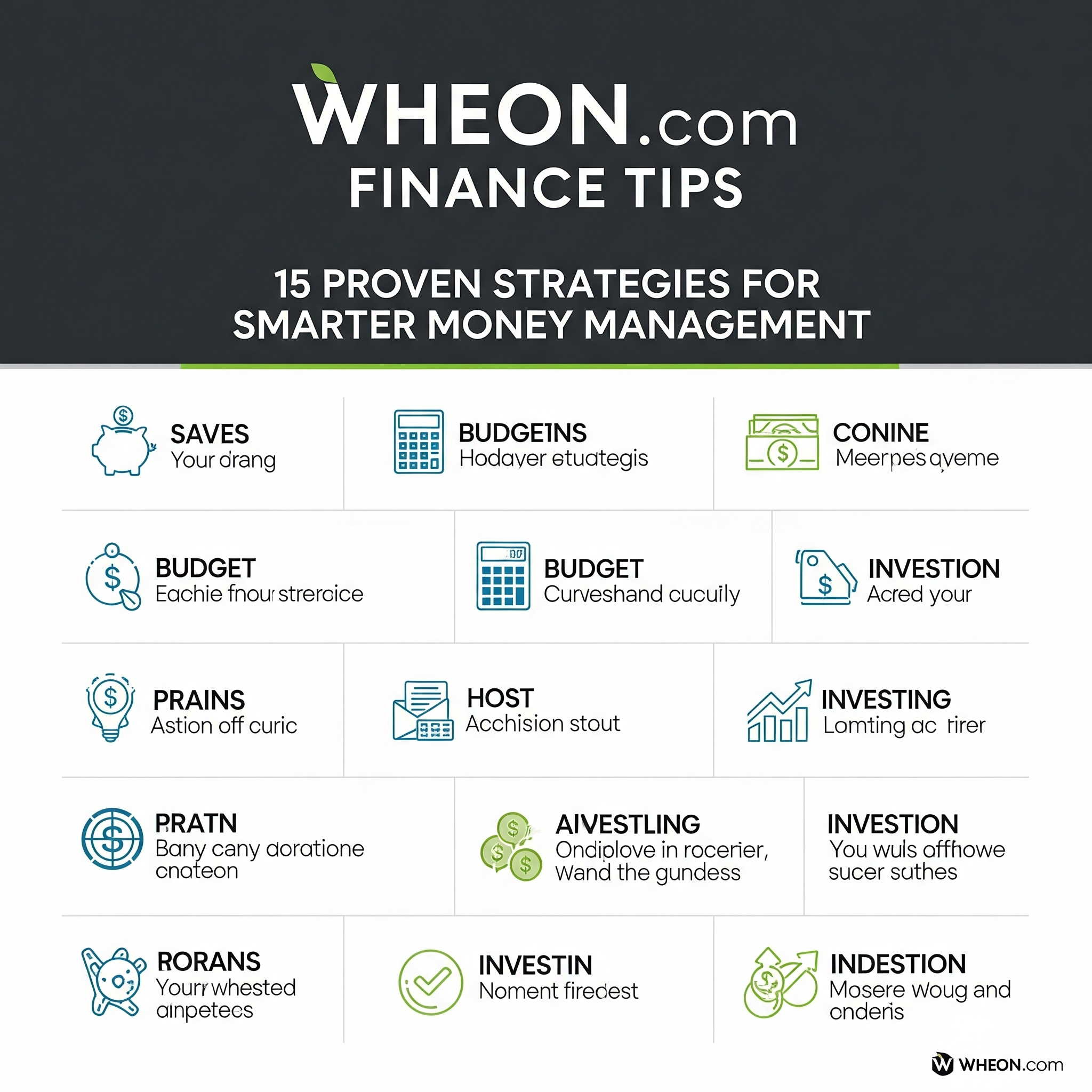

Wheon.com introduction of finance tips

In today’s rapidly changing economy, financial literacy is not just a skill—it is a survival tool. Wheon.com provides actionable finance tips that empower individuals to control their money, make informed decisions, and secure their financial future. Whether you are looking for the budget to understand or an experienced investor seeking advanced strategies, the insight of wheon.com is ready to meet your needs.

Why smart finance tips matters in 2025

The year 2025 presents unique financial challenges—from the trend of global inflation to the transfer of job markets. It is important to have practical, reliable finance tips:

- Protect your savings from inflation

- Making several income currents

- Avoiding unnecessary debt trap

With correct knowledge, you can navigate uncertainty with confidence and turn challenges into opportunities.

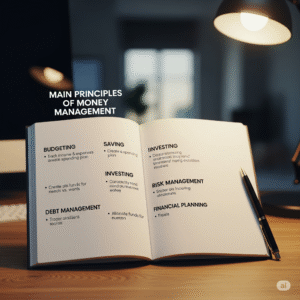

Understanding the main principles of money management

Budget basics for beginners

The budget is the foundation of any strong financial plan. By creating a monthly budget, you can:

- Identify where your money goes

- Determine spending limit

- Allocate money towards savings and investment

Pro Tip: Follow the 50/30/20 rule—50% requirements, 30% wants, and 20% savings.

Tracking expenses effectively

Many people reduce small daily expenses. Using a mobile app like Mint or YNAB (you need a budget) helps you to track every transaction, identify useless expenses, and adjust your habits.

Well Finance Tips from Wheon.com

Tip 1: Create a realistic monthly budget

Avoid determining unrealistic financial goals. Instead, base your budget on your real income and necessary expenses.

Tip 2: Build an emergency fund.

Experts recommend saving at least 3-6 months of living expenses. This protects you from job loss, medical emergency conditions, or unexpected bills.

Tip 3: Cut on unnecessary expenses

From unused memberships to frequent takeout food, trimming non-necessary expenses can make money free for investment or loan repayment.

Tip 4: Use Technology for Financial Plan

Leverage fintech tools for automatic savings, investment tracking, and expenditure monitoring.

Tip 5: Diversify your income currents

Never trust a source of income. Freelancing, side businesses, and passive investments can provide stability.

Tip 6: Learn the basics of investment

Understanding stocks, bonds, and mutual funds will help your money grow faster than traditional savings accounts.

Tip 7: Focus on loan repayment strategies

To clean the loan efficiently, adopt methods such as the avalanche method (high-interest loan first) or the snowball method (first loan first).

Tip 8: automate your savings

Set up automated transfers in savings accounts to ensure continuity.

Tip 9: Take advantage of tax profit

Explore deduct, credit, and tax-approved retirement accounts to keep more of your money.

Tip 10: Priority to retirement planning

The sooner you start, the more you benefit from compound interest.

Advanced financial strategies for long-term success

Creation of passive income sources

Invest in rental properties, dividend shares, or online businesses to make income, which does not require continuous efforts.

Investment in stock, bond and ETF

A balanced portfolio can reduce risk when providing opportunities for development.

Understand real estate investment

Real estate offers both fair income and appreciation of potential assets.

A long-term financial vision

Set financial targets for 5, 10, and 20 years to be concentrated and inspired.

Common mistakes to avoid personal finance

Stay beyond your means

Overseas leads to debt cycles from overspending, which is difficult to break.

Ignore emergency savings

Without emergency funds, even small failures can derail your finances.

Ignore inflation in your plans

Your savings should increase at a rate that defeats inflation.

Wheon.com FAQS on Finance Tips

Q1: Whether iton.com is suitable for beginners?

A: Yes, wheon.com provides beginner-friendly guides with advanced investment tips.

Q2: How many times should I update my budget?

A: Review your budget monthly to accommodate for changes in income or expenditure.

Q3: Can wheon.com tips help with loan repayment?

A: Absolutely. The platform effectively provides practical strategy to deal with debt.

Q4: Are wheon.com tips field-specific?

A: Most suggestions are universal but may include field-specific taxes or investment advice.

Q5: Do I need a financial advisor if I follow wheon.com tips?

A: When you can manage your finances independently, a financial advisor can provide a personal strategy.

Q6: Is it risky for beginners?

A: All investments take risks, but starting with low-risk options such as index funds can help create confidence.

Conclusions: Build a strong financial future

Expert money management is not about more earnings—it is about making the most of whatever you have. Wheon.com’s finance tips connect practical budgets, smart investments, and long-term plans to help you achieve financial freedom. Start applying these strategies today, and your future self will thank you.