What Is Afterpay?

Afterpay is now a buy now, pay later (BNPL) service that allows shopkeepers to buy upfront and divides payment into four equal, interest-free installments. Instead of paying the entire amount at the checkout, users can make manageable payments every two weeks.

Established in Australia in 2014, afterpay has increased as a global player, and it is now in the US, Canada, and the UK. And it is serving millions of customers in New Zealand. It is the most popular among Millennials and Generation Z, who seek flexible payment options without relying on traditional credit cards.

History and Growth of Afterpay

-

2014: Founded by Nick Molnar and Anthony Eisen in Sydney, Australia.

-

2017: Entered the U.S. market.

-

2020: Partnered with major retailers like Sephora, Urban Outfitters, and Forever 21.

-

2021: Acquired by Block, Inc. (formerly Square) for $29 billion.

Afterpay’s explosive growth is attributed to the shift in consumer behavior—where people want to spend smarter and avoid credit card debt.

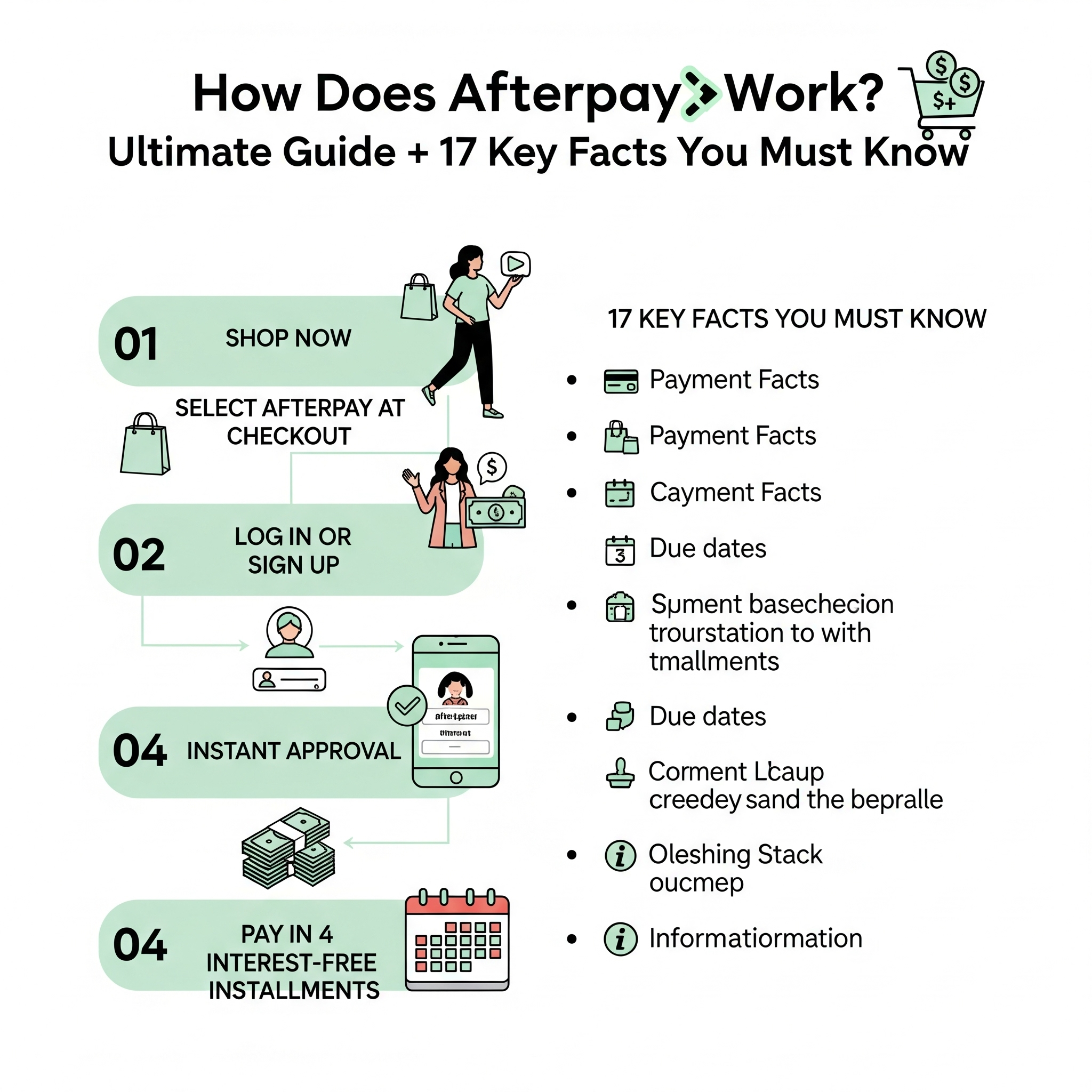

How Afterpay Works: Step-by-Step

Step 1: Choose Afterpay at Checkout

When purchasing online or in-store, select Afterpana as your payment method. You will be motivated to either sign up or log in to your afterpay account.

Step 2: Pay the First Installment

You’ll pay 25% upfront. For example, if your purchase is $200, your first payment will be $50.

Step 3: Automatic Payments Every 2 Weeks

Afterpay automatically deducts the next three payments—$50 every two weeks—from your debit or credit card. No interest, no fees—as long as you pay on time.

Where can you use afterpay?

Later partners with over 100,000 retailers worldwide. Some popular categories and shops include

Category retailer

- Fashion ASOS, Urban Organization, Forever 21

- Beauty Sipora, reverse

- Tech Samsung, JBL

- Home Bed Bath and Beyond, Anthropologi

- Fitness Adidas, Jimshark

In-store use is supported in many places by scanning the afterpath barcode through the app.

Who Can Use Afterpay? Eligibility Criteria

To use Afterpay, you must:

-

Be 18+ years old

-

Reside in a country where Afterpay is available

-

Have a valid debit/credit card

-

Pass a soft credit check during sign-up

Afterpay may approve or deny transactions based on your repayment history and the purchase value.

Benefits of Using Afterpay for Shoppers

-

No Interest if paid on time

-

Easy budgeting via installment payments

-

Instant approval—no credit score impact

-

Encourages mindful purchasing

-

Integrated with thousands of trusted brands

Risks and Limitations of Afterpay

While Afterpay can be a handy tool, it comes with some potential pitfalls:

-

Late Fees: Ranges from $8 to $10 per missed payment

-

May lead to overspending

-

No reward points like traditional credit cards

-

Limited refund flexibility if returning items

Afterpay for Businesses: How It Helps Retailers

Retailers benefit significantly from offering Afterpay:

Increased Sales and Conversions

Merchants see up to 30% higher conversion rates and larger average order values.

Lower Cart Abandonment

Shoppers are more likely to complete a purchase when flexible payment options are offered.

According to Retail Dive, BNPL options reduce cart abandonment by up to 35%.

Is Afterpay Safe and Secure?

Yes. Afterpay uses:

-

PCI DSS Level 1 Compliance

-

SSL encryption

-

Two-factor authentication

Your payment info is encrypted and not shared with third parties.

Does afterpay affect your credit score?

Generally, afterpay does not affect your credit score. However:

- No hard credit check

- Late payment can be reported when seriously overdue

- Responsible use may indirectly improve your financial behavior

Afterpay vs. Klarna vs. Affirm: A Comparison

| Feature | Afterpay | Klarna | Affirm |

|---|---|---|---|

| Interest-Free? | Yes | Yes (Pay in 4) | Sometimes |

| Credit Check? | No | Soft check | Soft/Hard check |

| Installments | 4 biweekly | 4 biweekly / monthly | Monthly |

| App Interface | Simple & clean | Feature-rich | Finance-focused |

Tips to Use Afterpay Responsibly

-

Set reminders for payment due dates

-

Use for planned purchases only

-

Don’t stack multiple BNPL plans

-

Monitor your spending in the app

-

Link to debit card to avoid credit debt

Afterpay app facilities and interfaces

- Easy Tracking of Purchase

- Information for payment

- Barcode scanner for in-store use

- Explore stores, deals and publicity

- Reassessment of payment (once per order)

Questions to Ask

1. Can I pay off my afterpay plan quickly?

Yes, you can make initial payments anytime through the app or website.

2. What happens if I miss payment?

Until the payment is made, you will be charged a late fee, and your account can be stopped.

3. Is it better than a credit card?

It depends. Afterpay does not charge any interest, but there is a shortage of prizes. Credit cards provide points but can get interest

4. Can I use Afterpay for membership?

No, afterpay is designed for only once the purchase is made.

5. Does he later work internationally?

Yes, but only with retailers participating in those countries who support it.

6. Can I return items purchased with afterpays?

Yes, but the refund is handled by the retailer. Afterpay will adjust your installment plan accordingly.

Conclusion

Afterpay has brought a revolution to the way of shopping by providing interest-free, flexible payment solutions to the people. This is ideal for budget-conscious consumers who want to spread the cost without a loan. However, like any financial equipment, responsible use is important to ensure that it helps rather than damaging your finances. Whether you are a shopkeeper or a retailer, understanding how to work, better buying experiences, how to increase customers’ satisfaction, and more sales can work.